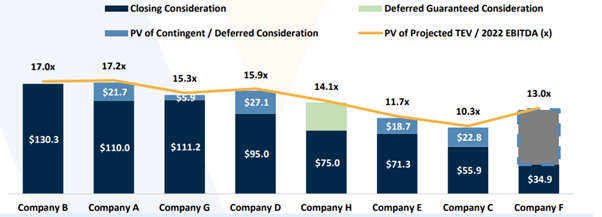

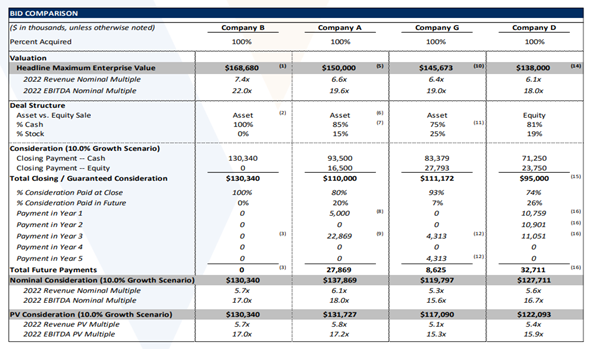

The client, an Investment Bank, wanted the TresVista team to prepare a financial model leveraging various bids received for a sell-side mandate and calculate a realistic consideration at which the potential buyers value the mandate. The client also wanted the team to analyze different bids based on closing considerations along with retention payments & earnouts and create a summary providing all the metrics like EV/EBITDA, EV/Revenue, Total Consideration, etc. Moreover, the client requested the team to evaluate the considerations payable on future dates and the PV of those payments to make bids comparable.

To analyze and model various bids received for a sell-side mandate to arrive at a realistic and comparable valuation.

The TresVista team followed the following process:

The major hurdles faced by the TresVista team were:

The TresVista team overcame these hurdles by conducting a thorough analysis of all the bids. All the covenants were understood individually, and formulae were built to cater to all the covenants.

The TresVista team added value by providing a summarized view of all the bids along with a visual representation of the multiples associated with the valuation. Later, the team also created a detailed SOP for the project for new analysts, joining the client or the TresVista team.