Case Studies

Strategic Solutions and Experts Services Building Client Success Stories

How we helped a Private Equity firm in building an operating model and investor presentation

The Context

The client, a US-based Private Equity firm that invests in consumer, sports, and media, wanted TresVista Team to research recent trends in the digital media sector and digital advertising ecosystem. The client also wanted the team to rebuild the operating model with two revenue streams and create and update valuation materials and Investment Committee (IC) memos.

The Objective

To rebuild an operating model and creation of valuation materials through different stages of the deal lifecycle.

The Approach

The TresVista Team followed the following process:

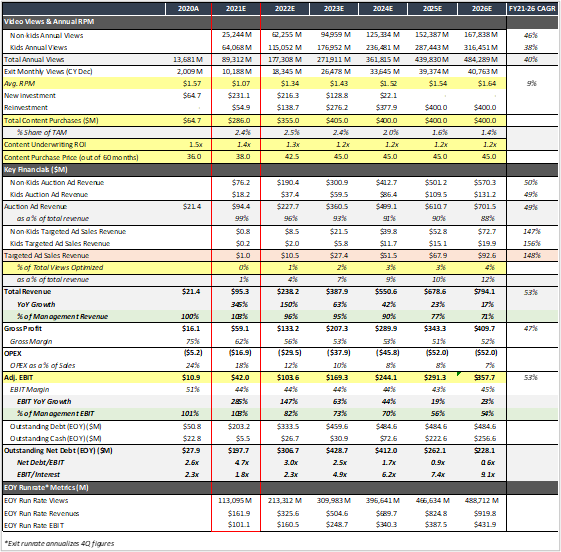

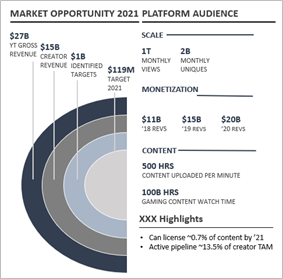

- Gathered industry data using desktop research and conducted an exhaustive analysis of the company’s near-term content acquisition pipeline

- Performed comparable analysis for high-growth media tech companies and created a 3-case operational model

- Created and updated valuation material and IC memos through the deal process

The Challenges We Overcame

The major hurdles faced by the TresVista Team were:

- Developing an in-depth understanding of the YouTube creator economy and ad monetization outlook

- Difficulty in identifying relevant metrics and understanding the scalability of the business model

The team overcame the hurdles by deep diving into the economics of YouTube creators. The team also had calls with the client to understand the business model.

Final Product (Sanitized)

The Value Add – Catalyzing the Client’s Impact

The TresVista Team built a run-off model where the company ceases all operations, stops all new content purchases, fails to build ad optimization, and runs the business for cash with ~10% of expected opex. The team also made an IPO exit model where the client will sell down in three equal-sized 6-month blocks starting 6 months after listing.