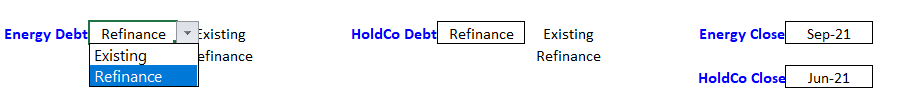

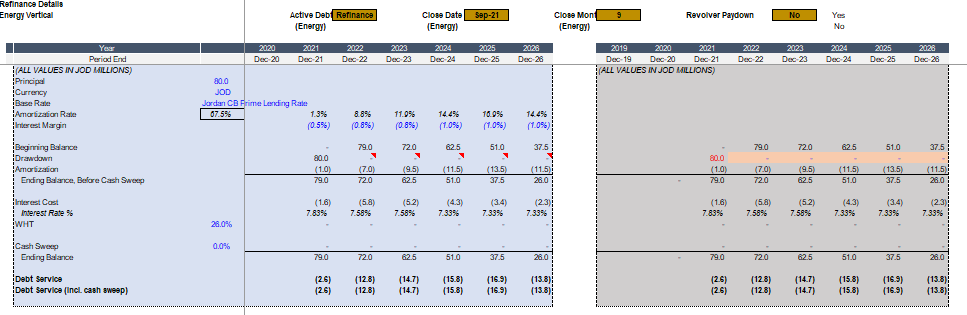

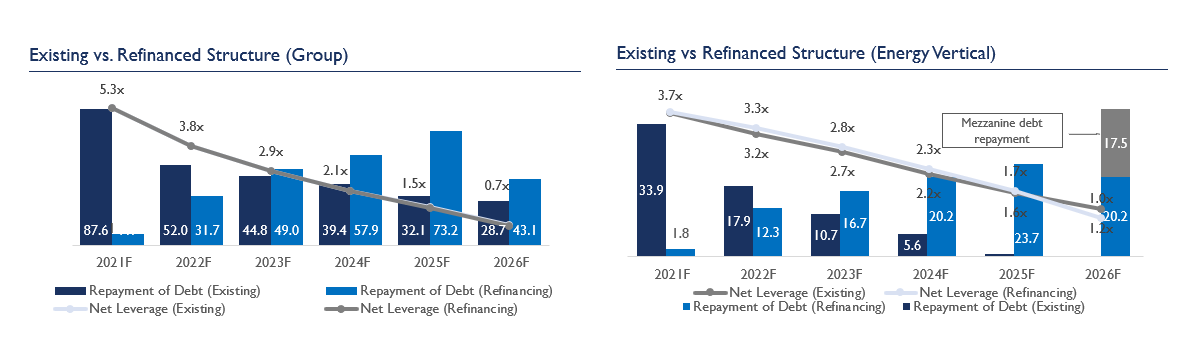

The client, a Jordan-based Conglomerate in the oil and gas industry, wanted the TresVista Team to build a financial model at the business segment and consolidated group level that represented cash flow improvement between existing terms and the refinanced scenario. The client also wanted a pitch presentation regarding the restructured company’s outlook for the financers.

To align debt repayments with expected cash flows and bring efficiency to the capital structure of the conglomerate.

The TresVista Team followed the following process:

The major hurdle faced by the TresVista Team were:

The TresVista Team overcame these hurdles by drafting the queries that can be answered in simple Yes/No. The team provided a detailed excel analysis to make the management understand the discrepancies and directly provide the team with the missing links. To change the pitch deck story, the team aligned the new set of information to the previous set to understand the lag between the two and accordingly update the model.

The TresVista Team performed an in-depth analysis to determine the revenue for the oil and gas business attributable to the trading profit and validated the concept of contractual margins applicable to the Jordanian oil and gas business. The model included actual financials till FYE20; however, as the deal proceeded and new quarterly numbers were released, the team did a comparative analysis of the forecast vs actual numbers.