TresVista | Leading Financial Service Provider

The Context

The client, a diversified global company spanning ten sectors, wanted the TresVista Team to perform due diligence on a Real Estate crowdfunding platform (RECF) that allows users to acquire fractional ownership in residential Real Estate (RE) across Dubai. The client wanted to off-load its residential inventory on the platform and benefit from any potential upside on the investment.

The Objective

To perform due diligence on a Real Estate crowdfunding platform and research the potential investor base that could be targeted in the next five years.

The Approach

The TresVista Team followed the following process:

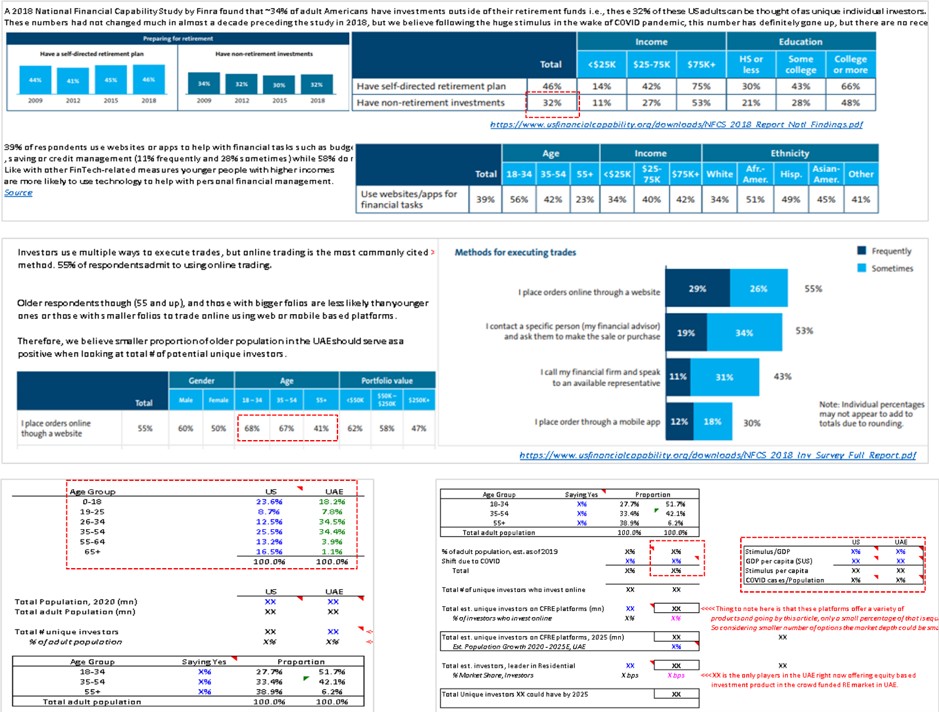

- Selected the Target Group – the percentage of adult U.S. population buying stocks online

- Dwelled into their demographic divide to equate it with the U.A.E. market

- Adjusted the above estimates for the COVID spike in retail investing

- Created a list of potential users that the client could target in the next five years and the inventory count that the client could sell through the platform

The Challenges We Overcame

The major hurdle faced by the TresVista Team were:

- Lack of availability of financial data for the U.A.E. market, including the absence of the breakup of the preferred financial instruments and the method of transactions to purchase those instruments

- Determining the overlap of investors between different RECF platforms in the U.S. and the total proportion of population investing on those platforms

- Sensitizing the data points for the U.S. market and applying them to the U.A.E. market

Due to the lack of comprehensive data for the U.A.E. market, the TresVista Team took the U.S. market data as a proxy to determine the Total Addressable Market (TAM) and created a bridge between the two countries’ numbers based on their financial literacy.

Final Product (Sanitized)

The Value Add – Catalyzing the Client’s Impact

The Team provided the client with insights into the following:

- The potential number of users that could be targeted in the U.A.E.

- Number of apartments that the client could sell annually till 2025

- Assets Under Management expected to be managed on the platform

- Analyzing the customer acquisition cost of client vs. peers and if the target had the resources to increase the sales and marketing costs

- Research on the regulatory environment in the Middle East

The above helped the client grasp a firm understanding of the regulatory environment around RECF and determine the value they can generate from the platform and the inventory they can sell on it.