Request and Guidelines Provided

- The client required assistance in preparing the Pitchdeck during the start of the fundraising process for the new fund

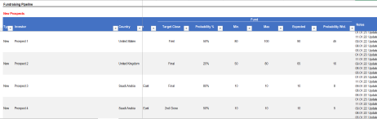

- The TresVista team updates the client’s fundraising pipeline periodically throughout the entire fundraising process

- The TresVista team proactively updates the client’s data pack with updated quarterly operational and valuation metrics as the same is shared with prospective LP’s

- The team also required to do a portfolio company ESG screening on a periodic basis which is used by the client to field the ESG concerns of the prospective LP

Final Deliverable and Value-add

- The Tresvista team leverages the portfolio management CRM and the internal design team’s assistance in creating visually appealing slides for the Pitchdeck

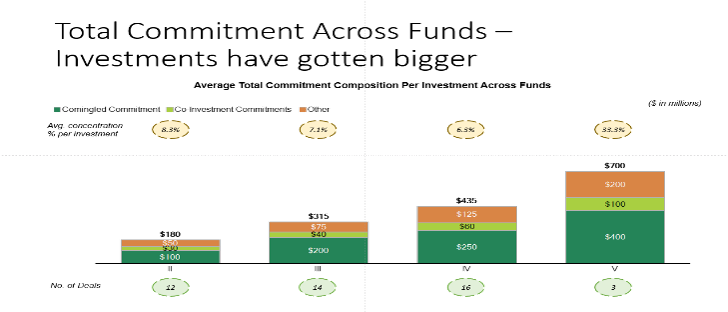

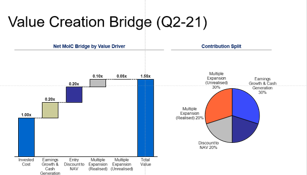

- The team also leverages Preqin database and provides value added analysis and presentation slides showcasing various industry level metrics for their Pitchdeck (Returns comparison over L5Y on GP Secondaries vs. Buyout Funds vs. Clients’ Fund, etc.)

- The team leverages various historically shared reports, legacy knowledge and portfolio management CRM for various ad-hoc requests of the prospective LPs

Methodology

- The TresVista team periodically updates the clients fundraising pipeline, tracking the interactions conducted by the client with the prospective LPs and also tracks the commitments made by the LPs that are closed

- The team assists the client in preparing the Pitchdeck by leveraging the portfolio management CRM for valuation metrics, creating trophy asset case studies, along with comparing the historical fund returns data with similar strategy funds of other PE firms

- The team works on the DDQ questions that are shared by prospective LPs leveraging the clients ILPA DDQ questionnaire repository

Snapshots of the Output