Request and Guidelines Provided

- The client required TresVista to update their asset-level and fund-level models and update the case managers showcasing the financials at different investment cases

- The team also updates the re-forecast models and capture any significant event (NAV update, dividend recap, debt restructure, etc.)

- The team also updates and link any asset-level cash flow or returns change in the consolidated fund-level cash flow model to ensure accuracy across all models

- The team also leverage outputs from the asset-level and fund-level model for other portfolio management workflows and deliverables

Final Deliverable and Value-add

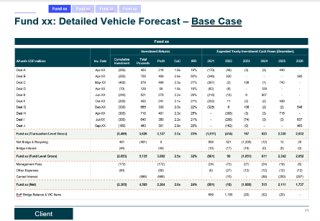

- The TresVista team tracks the cashflows through the client’s portfolio management CRM and updates the asset level models with the updated figures on a quarterly basis to track their contributions and distributions

- The team additionally assists the client to restructure the asset level models to a standard template streamlining the model to an easy-to-use template, helping the client’s team to navigate with ease, saving them time while reviewing and re-updating the models

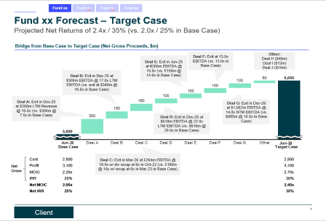

- The team assists the client by providing them with a fund level base vs. target case output alongside creating value bridges showcasing the factors that would influence any change in the valuation of the assets

Methodology

- Periodically, the team receives the quarterly reports of some of the client’s portfolio companies

- The analyst is responsible for capturing all the updated operating metrics, updated NAV, debt repayments, forecasted exit date and other relevant asset level metrics in the model

- Upon updating the model, the team conducts relevant analysis to showcase the updated returns and track the reasons for the change in returns (Equity value bridge, Returns bridge, etc.)