Request and Guidelines Provided

- The client required the team to work on creating the asset-level and deal-level model and build in different case managers showcasing the financials across different investment cases

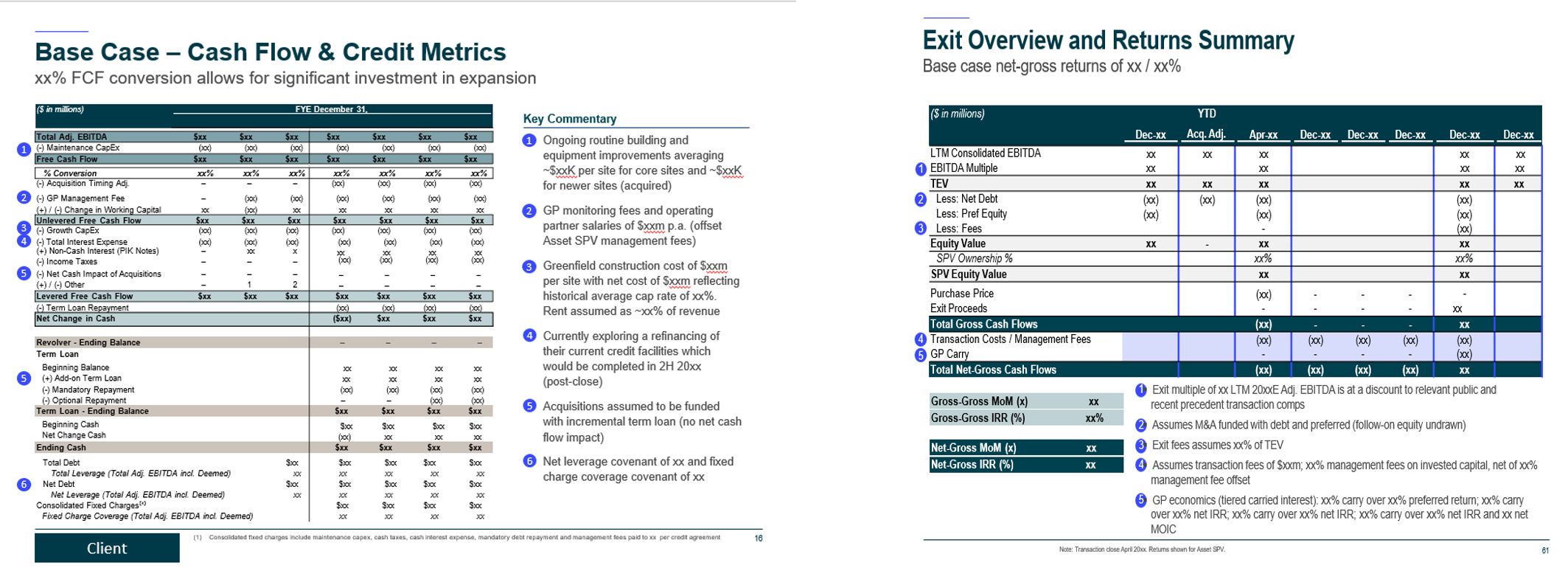

- The team was also asked to create certain outputs (Income Statement, Cashflow, Balance Sheet outputs) which form a part of the IC presentation

- The team also creates various analysis in the model (EBITDA bridge, waterfall, returns summary, sensitivity analysis, etc.)

- The client asks the team to consolidate the asset-level model into one master deal waterfall model in order to ascertain the total return of the opportunity per the client’s assumptions and management fee structure

Final Deliverable and Value-add

- As multiple layers of the team reviews the model (Analyst, Associate, and VP), it allows the team to gain a thorough understanding of the GP forecasts and industry estimates

- The associate adds an additional layer of review to the model and checks for any inconsistencies in the model, informing the same to the client saving the client a considerable amount of time in the due diligence process

- The VP leverages legacy knowledge of previous deals in the similar industry for creating additional KPI analysis (e.g. four-wall EBITDA, revenue per customer, etc.)

- The team provides a detailed summary of the value creation metrics for a particular transaction (M&A, organic growth, etc.) to the client

Methodology

- The analyst builds case managers with the provision of modelling multiple investment cases

- VP provides inputs on assumptions across different cases in consultation with the client

- Assists the deal team in creating cash flow waterfalls by layering in multiple levels of economics and assumptions for net-gross and net-net returns for single-asset as well as multiple-asset deals to determine the returns profile

- Build output tabs for the credit metrics summary, entry and exit overview, and sensitivities to be included in the IC presentation