Request and Guidelines Provided

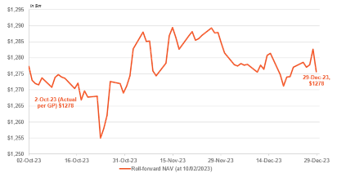

- The client sought TresVista’s assistance to track the NAV of a Multi-Asset deal comprising of numerous assets in various geographies

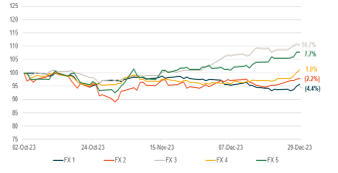

- The team was required to track the FX and Share price impact on a monthly basis on the quarterly NAV

- The client asked the team to create analysis outputs showcasing the impact of Fx movements on the NAV on a periodic basis (L1M, L3M, YTD, Since IC, etc.)

- Furthermore, the team produces a range of analyses delineating the Net Asset Value (NAV) breakdown for all assets on a month-to-month basis

Final Deliverable and Value-add

- Given the deal comprised of more than 30 assets located in various geographies, the team created a standardized excel detailing the NAV calculation process, providing the client with an ease of navigating and analyzing the excel file

- The associate created multiple checks at each stage of the analysis to ensure accurate flow of numbers throughout the Excel file

- The team also highlights details on events when there is a significant movement in the NAV along with key forward looking macro events to assist the client in projecting the reforecasts

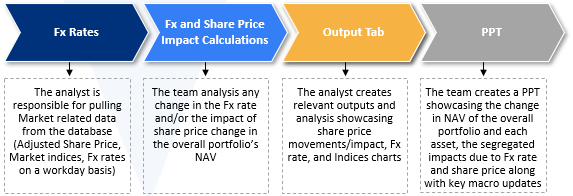

Methodology