Request and Guidelines Provided

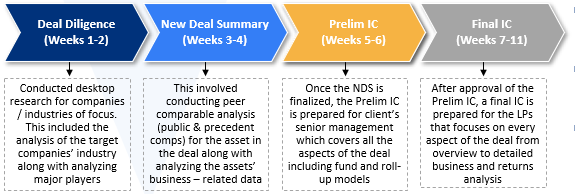

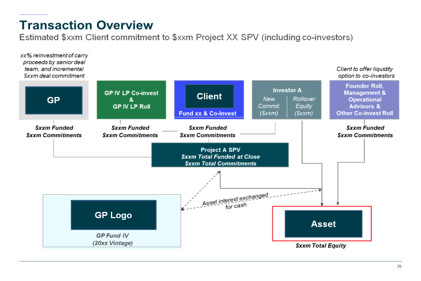

- The client’s deal team required TresVista to work on a variety of requests ranging from presentation, research and due diligence activities, preparation of asset and fund models, valuation exercises, etc.

- The team was asked to conduct research for companies/industries in focus alongside sourcing relevant equity research and broker reports

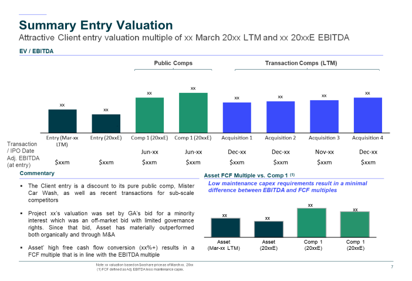

- Conduct valuation analysis through public comps, transaction comps, and overtime valuation charts, along with creating a waterfall model with a returns summary

- Eventually, the TresVista team assisted the client to create a detailed presentation covering all the relevant aspects of the deal across the entire IC presentation process

Final Deliverable and Value-add

- The analyst creates outputs for the IC deck by creating presentation slides, peer comparables, waterfall model, returns summary, EBITDA bridges, etc. and provides key commentary on any significant event/change

- The team provides an extra layer of review to the IC deck making it extremely convenient for the client to meet quality requirements (final checks, formatting consistency, consistency in numbers across slides) and meet the transaction timelines

- The VP ensures proper staffing during the live deal process and seeks additional bandwidth during periods of overutilization to ensure stringent timelines are met. The VP also utilizes past deal experience and provides relevant value-add throughout the entire IC preparation process

Methodology