Request and Guidelines Provided

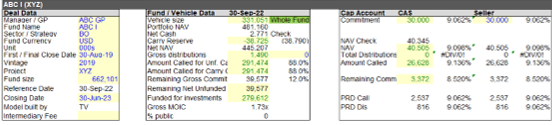

- The client operates in the Secondaries PE market dealing in LP stakes evaluating portfolios with multiple funds

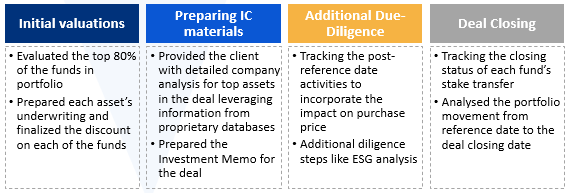

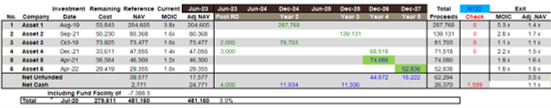

- TresVista’s role was to analyze and value all the assets within each fund, and project returns accordingly

- The deal team also required assistance through the deal process including tracking the returns through the deal process incorporating the post-reference date activities and carrying out additional ad-hoc analysis while evaluating the deal

Final Deliverable and Value-add

- Outputs included models pricing 25 funds, the Investment Memo, and additional DD such as PRD and ESG analysis, term sheet analysis, and closing trackers

- Assisted the client draft an initial bid proposal for a $300mn deal in a week with over 97 funds

The VP provided inputs based on experience while the client was finalizing the pricing of each fund

-As a part of the process, the team helped incorporate changes on a real-time basis ensuring quick turn-around

Methodology