Request and Guidelines Provided

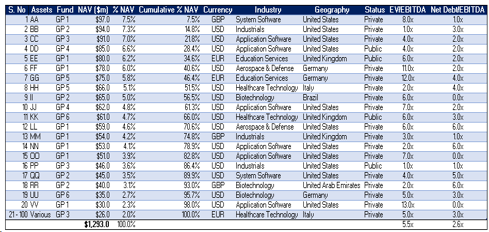

- After a deal gets logged in the CRM platform and the client decides to move ahead into the diligence process, a quick preliminary analysis is done where the fund and assets metrics are collated for the purpose of gaining an insight into the LP portfolio

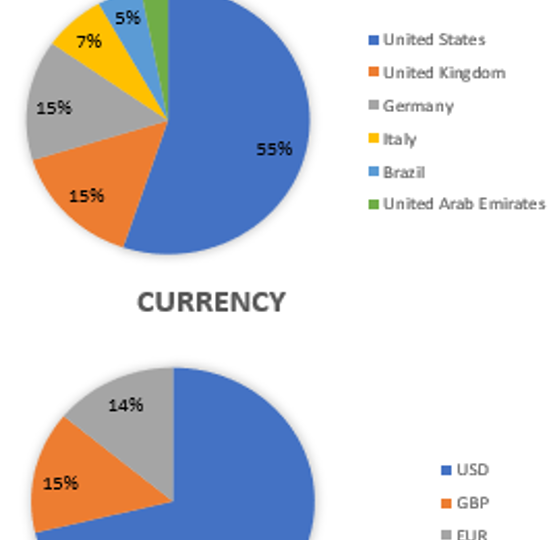

- The client sends over the dataroom containing seller’s Capital Account Statements and funds’ Quarterly Reports to commence the portfolio summary preparation in order to identify the top contributors (both by assets and funds) as well as their aggregate exposure

- Post this, the client leverages the operating and valuation summary of the portfolio and decide the next steps based on their investment strategy

Final Deliverable and Value-add

- The TresVista team has gained understanding of screening and selecting high-impact funds / assets in the sale portfolio

- TresVista has also created an efficient process around the portfolio summary exercise with a dynamic output model to analyze different funds and their respective assets with accuracy and automatically update output charts

- Lastly, TresVista provides a purview of the outliers in terms of exposure/valuation metrics such as larger-than-usual NAVs for assets, highly-leveraged assets, funds with unusual exposure to developing economies, etc.

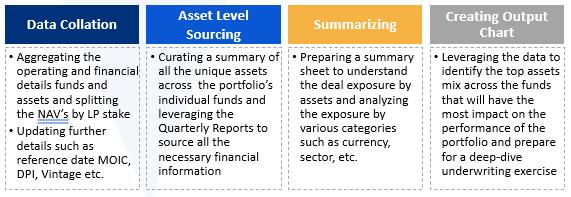

Methodology