Request and Guidelines Provided

- The client requires the TresVista team’s assistance in preparing their AGM deck

- The TresVista team reaches out to the respective deal team members for key statistics of their portfolio funds/assets

- The team also leverages Preqin for YoY fundraising data, dry powder analysis and compare the same with the clients’ fund status

- The client requires the team to leverage the portfolio management CRM for key valuation metrics that are showcased in the AGM deck

Final Deliverable and Value-add

- The associate adds valuable datapoints to the clients AGM deck, leveraging Preqin and conducting desktop research to attain key stats to show on the AGM deck

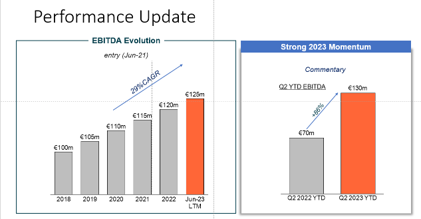

- The analyst conduct’s key valuation metrics analysis (DPI, RVPI, IRR) analysis leveraging legacy knowledge of the client’s CRM Database for fund level analysis

- The analyst leverages the QPR’s of the past year to add key commentary for the change in the valuations across deals

- The associate and VP provide an extra layer of review to the AGM deck making it extremely convenient for the client to meet quality requirements (final checks, formatting consistency, consistency in numbers across slides) and stringent timelines

Methodology

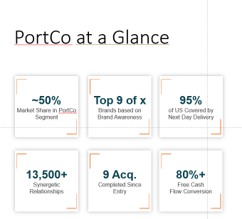

- The team leverages the internal design team for assistance in standardizing an aesthetic deal-level slide wherein the team inputs key metrics for all the client’s portfolio assets

- The team creates a PE market focused Macro – Overview section displaying how the clients performed in the past year with respect to the industry

- The team also conducts a portfolio analysis which is used in creating a case study section for the “trophy” assets in the client’s portfolio

- The team creates a section for deals acquired in the past year portraying the historical performance of the deals and the expected returns

Snapshots of the Output